The global electric mobility industry size stood at USD 101.67 billion in 2022 and will exhibit a CAGR of 19.9% from 2023 to 2030, according to the “Electric Mobility Industry Data Book, 2023 – 2030,” published by Grand View Research. The growth comes on the back of an exponential rise in smart cities and a gradual uptick in charging infrastructure. Further, the strong outlook of electric mobility will rely on the launch of new EVs, innovations in automotive technologies, urbanization, and per capita income. Mass awareness and education regarding electric mobility will elevate the trajectory of EVs across emerging and advanced economies.

Electric Two-wheelers are the Future

Global push to adopt sustainable practices and strong policies to curb carbon emissions have expedited the penetration of electric two-wheelers. Besides, several automakers have upped investments in research and development activities to augment the footprint of e-scooters. Soaring demand for electric two-wheelers is boosting the demand for sustainable mobility. Automakers have responded to the shifting trend with an injection of funds into the production of electric two-wheeler models. To illustrate, in April 2022, Honda Motor announced pouring USD 64 billion into R&D to introduce 30 EV models globally by 2030.

EV manufacturers are bullish about the flurry of innovations, including regenerative braking system advancements of battery technology. Predominantly, the regenerative braking system has provided a fillip as it helps to minimize maintenance costs through reduced wear and tear. The electric two-wheeler market size was pegged at USD 91.07 billion in 2022 and will witness a healthy CAGR of 13% between 2023 and 2030.

E-light commercial vehicles for Sustainable Mobility

With the decarbonization of vehicle fleets becoming more pronounced, electric light commercial vehicles (e-LCVs) are poised to gain ground. An expeditious growth of e-commerce and online grocery will reinforce the brand position. Lately, instant delivery and same-day delivery have gained considerable momentum, a trend witnessed during the COVID-19 pandemic that will continue in the ensuing period.

Furthermore, the proliferation of recreational vehicles and logistics, along with the demand for LCVs in construction, gardening, and landscape, has boded well for automotive manufacturers. The electric light commercial vehicles market size was valued at USD 9.30 billion in 2022 and will depict a strong CAGR of 39% through 2030.

Dynamics to Watch Out for in 2024 and Beyond

Trends and opportunities expected to be witnessed in the near term are highlighted below:

- Industry players are likely to underscore electric three-wheelers in their portfolios following the growing penetration of delivery- and passenger-car –vehicles. Some factors, such as cost saving, expansion of charging infrastructure, suitability for urban mobility, and technological advancements, have made E-three wheelers a promising investment.

- The automotive landscape suggests state-of-the-art technologies, including AI, IoT, big data, 3D printing, and vehicle-to-everything will redefine the global market.

- Competitive trends in Asia Pacific will likely encourage OEMs and other stakeholders to inject funds into electric mobility on the back of the rising footprint of e-bikes and other EVs across China, India, Australia, and Japan. Moreover, the adoption of electric two-wheelers will underpin Asia Pacific’s alignment with global climate policies and regulations to underscore traffic conditions. Automotive manufacturers are expected to cash in on the industry dynamics as the trend for EVs continues to gain popularity.

Europe Leaves No Stone Unturned

Europe has emerged as a promising market where EV adoption has reached an unprecedented height over the past few years, mainly due to shifting consumer preference towards sustainable transportation and bullish policies. For instance, in October 2022, the European Parliament and Council reached an agreement that will require all new cars and vans registered in Europe to be zero-emission by 2035.

The “Fit for 55” proposal will warrant average emissions of new vans to dip by 50% and new cars by 55% by 2030. The European Environment Agency noted that in 2021 electric car registration in the EU market contributed nearly 18% of newly registered passenger cars. In 2021, around 63% of BEV registration in the EU-27 and non-EU EEA countries was attributed to France, Germany and Norway.

E-Mobility Creates New Opportunities

With the transport sector being one of the major contributors to GHG emissions, investments in e-mobility could help them achieve climate neutrality objectives. Financial incentives, including exemptions and tax reductions, will ramp up EV adoption, thereby fostering electric mobility. Additionally, electric two-wheelers could be a silver lining amidst limited parking spaces and surging traffic congestion.

At a time when skepticism of the lack of charging infrastructure has grown gradually, consumer preference and regulatory pressure could compel automakers to shift toward EVs. As such, the establishment of charging infrastructure and installation of chargers at private homes could be a major shift toward decarbonization. Besides, stakeholders are expected to invest in recycled materials that can save 15 to 25 percent of production emissions.

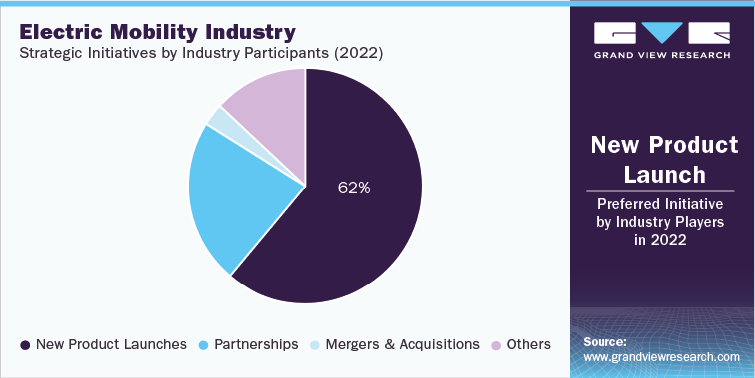

The competitive scenario alludes to notable investments in organic and inorganic growth strategies, such as product offerings, technological advancements, R&D, collaborations, mergers & acquisitions, and geographical expansions. To illustrate, in July 2022, Lime rolled out an AI-powered computer platform to enhance e-scooter safety. The company will start with its Advanced Sidewalk Detection system that can reportedly identify when the e-scooter is being ridden on a pavement (in real-time).

Read also about Micromobility Industry Witnesses Rising Footfall of Electric Bicycles

Tech content on this site may include contributed articles and partnerships with industry voices. Learn more in our Editorial Policy.